The ongoing pandemic affected thousands of businesses and millions of people in the country, prompting the government to develop a recovery plan that can help cushion the impact of COVID-19. One of the programs was the Financial Institution Strategic Transfer Act to help financial institutions recover.

Financial Institution Strategic Transfer (FIST) Act

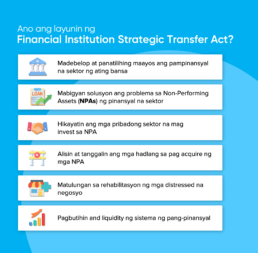

Republic Act (RA) 11523, also known as the Financial Institution Strategic Transfer (FIST) Act, was signed by President Rodrigo Duterte last February 16, 2021. It aims to ensure financial resiliency during the pandemic by:

- Addressing the non-performing asset problems of the financial sector

- Encouraging the public and private sector to invest in non-performing assets

- Eliminating existing barriers in acquiring non-performing assets

- Helping in the rehabilitation of distressed businesses

- Improving the liquidity of the financial system which can be used to grow the economy and maintain financial stability.

What’s the goal of the Financial Institution Strategic Transfer Act?

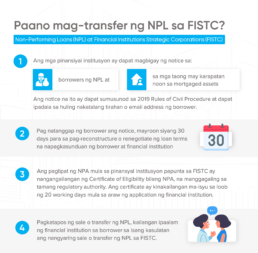

The COVID-19 program will facilitate the disposal and transfer of Non-Performing Assets (NPAs) and Non-Performing Loans (NPLs) of the public and private financial institutions by creating a corporation called Financial Institutions Strategic Corporations (FISTC).

Through FISTC, institutions such as commercial banks, rural banks, accredited microfinance nongovernment organizations (NGOs), government financial institutions (GFIs), and other institutions licensed by the BSP can offload their NPAs and NPLs.

This allows financial institutions to provide businesses access to capital and other financial resources. It will help them support their livelihood and stimulate the economy during the pandemic.

How to Transfer NPL to FISTC

Currently, the country’s non-performing loan ratio is at 4.21% in March 2021 but according to BSP Governor Benjamin Diokno, the banks’ NPLs ratio is expected to be above 6% by the end of December 2021. BSP predicts that within the two-year of implementation of the FIST Act, about 30% of total NPAs will be freed by financial institutions.

Through this program, the financial industry will become protected amid the COVID-19 crisis they are currently facing. The recovery plan will not only help improve the Philippine economy but also provide Filipinos good financial health which is essential to any country.

To read more on different support and assistance provided by the government financial industry to the Filipinos, click here.

Contributed by: Luisa Mae Gonzales

Related Posts

August 16, 2022

Manila’s 35 Fastest Growing FinTech Startups

PearlPay was selected by Fintech Energy, which monitors over 200,000 startups, as one of the…

June 21, 2022

MSME Financial Support Programs

Naglunsad ang gobyerno ng iba’t ibang loan programs para tulungan ang mga MSME sa bansa. Alamin…

October 26, 2021

Serbisyo sa Barangay: Livelihood Program for MSMEs

Serbisyo sa Barangay is a livelihood program that will equip MSMEs in barangays with the necessary…