HKSTP’s First-Ever Virtual Elevator Pitch Competition 2020

This was originally published by Businesswire

Global entrepreneurs vied for cash prizes of US$200,000 and built connections with leading corporates and investors in Hong Kong and beyond

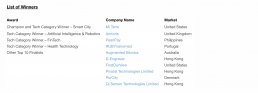

HONG KONG–(BUSINESS WIRE)–Hong Kong Science and Technology Parks Corporation (HKSTP) held its annual Elevator Pitch Competition 2020 (EPiC) virtually for the first time to unveil new and exciting pitching, investment and partnership opportunities as global startups face a challenging business landscape. US-based biotechnology startup, Mi Terro, topped other finalists to be crowned champion and claimed the top prize at the competition today.

HKSTP’s annual flagship event this year expanded to a week-long virtual programme. It garnered a great response with over 77,000 live views at today’s pitching competition. This year, EPiC attracted 476 entries from 37 countries and cities across five continents. A total of 170 contestants from 31 different markets entered the semi-final round, with nearly 70% of them coming from overseas.

Mi Terro, champion and winner of the Smart City category, is a company that upcycles and re-engineers protein food waste into plastic and cotton alternative fibres for the fashion, medical and packaging industries. The three Tech Category Winners, including UK-based AI & Robotics startup Arctoris, Philippines-based fintech startup PearlPay, and Portugal-based health technology startup RUBYnanomed, showcased their full potential as innovators in the competition.

Albert Wong, CEO of HKSTP, said: “This year’s successful staging of the 5th EPiC is a clear sign of our determination to provide a platform of unmatched opportunities to startups around the world to showcase their innovations and demonstrate their entrepreneurial spirit. The week-long programme is also a show of strength and resilience for Hong Kong’s rapidly-growing innovation and technology ecosystem which propels startups and their ideas to success in Hong Kong, Asia and beyond.”

Since inception in 2016, EPiC has drawn a huge number of international startups to make a live one-minute elevator pitch to leading investors and judges at the International Commerce Centre (ICC), the tallest skyscraper in Hong Kong. This year, our contestants switched modes to present their innovative business ideas, with a one-minute video pitch submitted to simulate the signature 60-second elevator ride.

The top ten finalists were given another opportunity to face the judges in a three-minute live pitch and two-minute Q&A, before announcing the overall champion, who took away a cash prize of US$100,000 while each of the category winners received a cash prize of US$10,000 and all ten finalists won US$6,000 each.

The competition marks a major progression for startups who gained valuable exposure among investors and industry leaders in their ongoing entrepreneurship journey. To further bolster the growth and development of local and overseas startups, this year’s EPiC provides a wider array of business opportunities to explore and acquire better understanding of the investment landscape in the region with the upcoming “Global Matching” programme from 9 to 12 November and the “Investment x Corporate Innovation Conference” on 13 November.

About Hong Kong Science And Technology Parks Corporation

Comprising Science Park, InnoCentre and Industrial Estates, Hong Kong Science & Technology Parks Corporation (HKSTP) is a statutory body dedicated to building a vibrant innovation and technology ecosystem to connect stakeholders, nurture technology talents, facilitate collaboration, and catalyse innovations to deliver social and economic benefits to Hong Kong and the region.

Established in May 2001, HKSTP has been driving the development of Hong Kong into a regional hub for innovation and growth in several focused clusters including Electronics, Information & Communications Technology, Green Technology, Biomedical Technology, Materials, and Precision Engineering. We enable science and technology companies to nurture ideas, innovate and grow, supported by our R&D facilities, infrastructure, and market-led laboratories and technical centers with professional support services. We also offer value-added services and comprehensive incubation programmes for technology start-ups to accelerate their growth.

Technology businesses benefit from our specialized services and infrastructure at Science Park for applied research and product development; enterprises can find creative design support at InnoCentre; while skill-intensive businesses are served by our three industrial estates at Tai Po, Tseung Kwan O and Yuen Long. More information about HKSTP is available at www.hkstp.org.

The Role of Agriculture: Rebooting the Philippine Economy

Photo Courtesy of Kiko Pangilinan Website

The COVID-19 pandemic emphasized the role of agriculture in Philippine economy. When import and export grounded to a halt due to strict social distancing measures, it showed the need for the country to be self-sustainable. With this in mind, the government aimed to strengthen the agricultural sector.

The vision now is to be a food-secure and resilient country that aims to help farmers and fisherfolk prosper. Providing better support will improve the country’s food production and supply even during times of crisis.

Reviving the Agriculture Sector during the Pandemic

Photo Courtesy of Freepik

There are three stages to guarantee the Philippines’ survival and recovery from COVID-19: survive, reboot, and grow.

The pandemic has shown the opportunity in which part of the sector needs more support and improvement. Determining these parts allowed the Department of Agriculture (DA) to be granted a Php31 billion supplemental budget to secure food production and supply during the health crisis.

The department is also seeking a Php66 billion stimulus package for 2021 to fund new programs for farmers and fishermen. This will be used to increase support for the sub-sectors that have been underfunded all these years.

Additionally, DA launched several initiatives that will help improve the development of agriculture in the Philippines and make farmers more competitive. One such program is under the Rice Competitiveness Enhancement Fund (RCEF). Through the Philippine Center for Postharvest Development and Mechanization (PhilMech), they will provide rice farmers with machinery and equipment.

It can help modernize rice farming and farm mechanization, reducing high production costs that rely on manual operations from land preparation to harvesting. With this, rice farmers can be more productive and earn more income.

But what does the role agriculture play in the Philippine economy?

Role of Agriculture in Economic Development

Photo Courtesy of Freepik

The National Economic and Development Authority (NEDA) and the Department of Finance (DOF) identified that agriculture and food have a big impact in rebooting the Philippine economy.

As an agricultural country, the Philippines is in the best position to have an agriculture-driven economy. As stated by Agriculture Secretary Dar:

“We believe that economic growth in agriculture is more effective at reducing poverty and food insecurity than growth in other sectors.”

By investing in this sector, there are benefits of agriculture to the economy that can be taken advantage of:

1. Agribusiness Opportunities

Photo Courtesy of Food and Agriculture Organization of United Nations

Agriculture is more than just farming. It’s a food system that can provide plenty of business opportunities during the pandemic. Due to the community quarantine, farmers and fishermen experienced difficulties in selling their produce. This provided agripreneurs the chance to set up new platforms, such as online agriculture stores, connecting farmers directly to consumers,

Aside from that, the government also launched several agripreneurship loans so that Filipinos, especially displaced OFWs and workers, can start their own agribusiness.

2. Improving Rural Employment

Photo Courtesy of DA: Philippine Rural Development Project

Agriculture is not just a job for farmers. It covers a wider scope, including jobs such as machinery making, food processing, distribution, transportation, manufacturing, and more.

In fact, the Philippine Statistics Authority found that agricultural employment accounts for 24.3% of the total employment in the country in 2018. This means that 9,998,000 million Filipinos have jobs in agriculture. Through the government’s initiative to boost agripreneurship, the country can create more jobs, reducing unemployment in the country.

3. Rural Development

Photo Courtesy of The OPEC Fund for International Development

As of 2018, there’s an estimate of 24.5% of poverty incidence in rural areas. Since agriculture is the main economic activity in the countryside, investing in this sector can reduce poverty and boost local development.

Economic experts have found that agriculture is a more profitable venture now. Ateneo de Manila Economist Alvin Ang shared that localized farm ventures within the rural origins of Filipinos may reap dividends for them during this pandemic.

An example of these opportunities is Sustainable Sagada. It’s an online farmers market that was conceptualized during the start of the pandemic. It aims to help Sagada farmers sell their products, reaching consumers in Metro Manila when there were no other ways due to the quarantine.

And with every delivery run that they have, more and more local providers have been joining them, from meat producers, jam and winemakers, bakers, beekeepers, and even potters.

According to founder Tracey Santiago, the overwhelming support they received enabled them to help people who lost their jobs. They hired them to help pack the produce and deliver the packed goods to households.

The rise of new agricultural initiatives and projects further highlights the importance of agriculture in Philippine economy.

Empowering Agriculture through Financial Support

Photo Courtesy of Empowering Filipinos Website

As mentioned before, agriculture is a food system. But in order to have a smoothly running system, you must have a strong foundation: our country’s farmers.

As Secretary Dar said: “For us to rise stronger from this Covid-19 crisis, the government must encourage the development of an agriculture-driven economy.”

And what better way to do that than providing accessible financial resources to Filipino farmers?

To solve this, the Department of Agriculture launched several financing initiatives to ensure that farmers are well-supported, and are implemented by government financial institutions (GFIs). Aside from GFIs, the DA also tapped rural banks so that farmers can have easier access to agricultural loans such as:

- SURE COVID-19 Loan Program

- Kapital Access for Young Agripreneurs (KAYA)

- Agri-Negosyo Program (ANYO)

- Agrarian Production Credit Program (APCP)

Rural Banking for Filipino Farmers

Photo Courtesy of Food Tank Website

Rural banks cater to the needs of farmers, fishermen, and even micro and small enterprises (MSEs). As of July 2020, there was an increase in agricultural-related loans used for raising, poultry, and other aspects of food production.

RBAP President Elizabeth Timbol had even urged that the government should prioritize the rural banks by making them conduits for all the relief measures to affected sectors in the society. This is because they are well-positioned to address their financial needs – and why it’s important to digitize rural banks.

Digitization can make financial services universally accessible for all, particularly to marginalized farmers. This can help solve the long-time problem of our farmers not having access to credit and financing. With digitalization, we can ensure that they can have access to adequate capital to sustain and ensure the growth of their livelihood.

By empowering rural banks, we are also empowering the role of agriculture in Philippine economy.

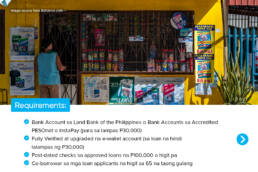

LIST: Government MSME Loan Programs in the Philippines (UPDATED)

Photo courtesy of Landbank of the Philippines

MSMEs play an important role in the country’s economy, providing jobs and encouraging development in rural communities. However, the COVID-19 outbreak affected them heavily as over 73% of MSMEs stopped their business one month after the ECQ last year. Around 10% are still closed as of June 2021.

As one of the most affected sectors, the government started a lending initiative to help MSMEs recover from the economic impact of the pandemic. Here’s everything you need to know about the MSME loans in the Philippines:

Pondo sa Pagbabago at Pag-Asenso (P3)

This MSME loan program from the Small Business Corporation (SB Corp) aims to provide an alternative financial line to MSMEs that borrow from informal lenders (5-6 money lenders).

Micro enterprises with an asset size not exceeding P3.0 million can borrow Php5,000 up to Php200,000 with a 2.5% interest rate per month.

How to Apply

Pondo Sa Pagbabago At Pag-Asenso (P3)

SB Corp is also partnering with financial institutions to make the loan program more accessible to MSMEs. Borrowers can visit microfinancing institutions (MFIs), cooperatives, and rural banks that are SB Corp partner lenders. You can view the list of P3 Partners here!

Expanded P3 Programs For COVID-19

In response to the pandemic, the government expanded the P3 Program and provided COVID-19 loans for MSMEs to help them sustain their businesses during the pandemic.

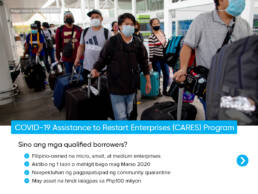

COVID-19 Assistance to Restart Enterprises (CARES) Program

The CARES Program is a Php1 billion Enterprise Rehabilitation Financing (ERF) loan facility under the P3 Program. MSMEs can avail of interest-free loans to help them recover from the economic impact of the pandemic.

This small business government loan program allows micro-enterprises with an asset size of not more than Php3 million to borrow Php10,000 up to Php200,000. Meanwhile, small enterprises with an asset size of not more than Php15 million can borrow a higher loan amount up to Php500,000.

On August 17, 2020, SB Corp reopened its second batch of online applications under Bayanihan Act 2 naming it as CARES 2. It requires all MSE applicants to apply online and will no longer accept manual applications.

CARES 2 Program Features

- Loan Limit: Microenterprises may borrow from P10,000 up to P200,000 and Small enterprises may borrow up to P500,000.

- Zero Interest Rate

- Grace Period: Maximum of 6 months. After 6 months loan amortization will start.

- Loan Amortization after Grace Period: Maximum of 12 months for loans not more than P50,000 and maximum of 24 months for loans more than P50,000.

- Service Fee: 6% if the loan does not exceed 18 months and 8% if the loan term exceeds 18 months.

How to Apply

COVID-19 Assistance to Restart Enterprises (CARES) Program

SB Corp reopened its second batch of online applications on August 17, 2020, naming it as CARES 2. It requires all MSE applicants to apply online and will no longer accept manual applications. You can send your application here!

Helping the Economy Recover through OFW Enterprise Startups (HEROES) Program

The HEROES program is also a part of the P3 program, providing a Php100 million loan facility to repatriated OFWs. It provides them with an opportunity to start their own business as an alternate source of income.

By availing this loan for Philippine MSMEs, applicants may borrow Php10,000 to Php100,000 that’s free of interest and collateral. However, a 6% service fee will be charged to loans with 24 months payment terms while there’s an 8% fee for loans with 36 months payment terms (inclusive of 12 months grace period.)

How to Apply

Helping the Economy Recover through OFW Enterprise Startups (HEROES) Program

Applicants must first register for the Philippine Trade Training Center’s online training for start-ups (access the form here.) Qualified applicants will receive instructions on how to apply for the MSME loan from the government after the training.

MSME Credit Guarantee Program (MCGP)

The MGCP is a guarantee offered by the Philippine Guarantee Corp. (PhilGuarantee). It aims to increase the availability of credit from the banking sector while also providing much-needed financial support to MSMEs.

As of February 2021, a total of 8,839 MSMEs have availed the program – releasing Php952.5 million in loans from 10 accredited banks and financial institutions.

MCGP Features

- Eligible Borrowers: MSMEs affected by the covid-19 pandemic.

- Loan Amount: Maximum of Php 50 million per borrower. Loans of over Php 50 million are subject to PHILGUARANTEE’s regular credit guarantee program guidelines before they can be accepted.

- Guarantee Limit: 50% coverage for working capital loans, and up to 80% for terms loans for capital expenditures.

- Fees: 1% guarantee fee per year and Php 5,000 amendment fee.

How to Apply for MCGP Program

Interested borrowers must file an application and submit all the needed requirements to the accredited lending partners. After this, PhilGuarantee will advise the approval of the guarantee coverage to the accredited bank or financial institution.

PhilGuarantee has extended the validity of MCGP until September 2021. If you have any questions or inquiries about the program, you can reach them here.

Through the MSME loans, the MSME sector can continue to support and improve their livelihood in the Philippines.

You can also check out agricultural loans for farmers, fishermen, and agribusinesses here!

LIST: Department of Agriculture’s Loan Programs for Farmers and Agripreneurs (UPDATED)

The COVID-19 pandemic has highlighted the importance of agriculture. Countries are aiming to be self-sustainable, reinforcing the agriculture sector to strengthen food security, and the Philippines is no exception.

According to Agriculture Secretary William Dar, the vision now is to be a food-secure and resilient country with prosperous farmers and fisherfolk. This is why the Department of Agriculture (DA) has launched new agricultural loans and enhanced existing programs to help improve agriculture in the Philippines.

SURE COVID-19 Loan Program

SURE COVID-19: Expanded SURE Aid and Recovery Project

In light of the pandemic, the Department of Agriculture through the Agricultural Credit Policy Council (ACPC) approved a Php246.3 million in loans of its Expanded SURE Aid and Recovery Project or SURE COVID-19 financing program. This is part of their Plant, Plant, Plant program that aims to increase the country’s food adequacy level.

How to Apply

For marginalized farmers and fisherfolks:

How to Apply for SURE COVID-19 Loan Program for marginalized Farmers and Fisherfolks

Eligible farmers and fishers enrolled in the Registry System for Basic Sectors in Agriculture (RSBSA) may borrow up to Php25,000, with no collateral and interest, which can be paid in 10 years.

For agri-fishery micro and small enterprises:

How to Apply for SURE COVID-19 Loan Program for Agri-Fishery Micro and Small Enterprises

Micro and small enterprises (MSEs) that are focused on agri-fishery can avail working capital loans up to Php10 million. It is payable in 5 years with no interest so that affected MSEs can continue operating during the pandemic.

You can apply for the loan program by sending an email to pdd@acpc.gov.ph or at surecovid.19@gmail.com. Make sure to submit the necessary documents in the email and include your business name, name of contact person, phone number, and your province.

Kapital Access for Young Agripreneurs (KAYA)

The KAYA program is part of the Department of Agriculture youth programs. It will help finance the capital requirements of start-up or existing agri-based projects of young entrepreneurs and agri-fishery graduates.

The program also includes capacity building training provided by state universities and colleges, government agencies, and other providers of Business Development Services (BDS). Qualified borrowers will receive technical assistance and training on mentoring, innovative financing, business planning, marketing, and product packaging.

How to Apply

How to Apply for Kapital Access For Young Agripreneurs (KAYA)

Visit the nearest government financial institutions (GFIs) or non-government financial institutions (NGFIs), like rural banks, cooperative banks, NGOs, and other private financial institutions, to apply for the loan. Borrowers can avail up to Php500,000 loan with 0% interest and can be paid within five years.

Agri-Negosyo Program (ANYO)

The ANYO loan program offers loans to agri-fishery MSEs that can help fund their capital requirements, operations, or fixed asset acquisition (facilities construction, equipment, machinery).

Like KAYA, it also provides capacity building where borrowers can receive technical assistance and training to help them improve their business.

How to Apply

How to Apply for Agri-Negosyo Program (ANYO)

The program is divided into 2 categories:

1. Micro Agri-Negosyo Loan facility: borrowers may loan up to Php300,000 with no interest and can be paid within five years.

2. Small Agri-Negosyo Loan facility: borrowers may avail a loan of Php300,000 up to Php15 million with no interest and can be paid in five years.

ANYO Program Expansion

Updated on February 8, 2021

In February 2021, the program was expanded to include eligible farmers and fishers’ cooperatives associations (FCAs) as qualified borrowers to help improve the food supply chain in the country. Through ANYO, FCAs may avail a loan of up to Php5 million with no interest and can be paid within five years.

Agrarian Production Credit Program (APCP)

The APCP is a joint program by the Department of Agriculture, the Department of Agrarian Reform (DAR), and the government-owned bank, LandBank of the Philippines (LANDBANK).

The program caters to Agrarian Reform Beneficiaries (ARBs) whose organizations are not yet eligible to avail of loans from LANDBANK. It aims to achieve sustainable crop production and increase incomes of ARBs and their households by providing credit and capacity building assistance.

How to Apply

How to Apply for Agrarian Production Credit Program (APCP)

Qualified borrowers can get a loan of up to 80% of the total project cost. Projects with existing production loans can get up to 10% of the outstanding loan portfolio while those without existing production loans will not exceed a loan of Php 1 million per ARBO.

Agripreneurship Loan Program For OFWs

The Department of Agriculture is also encouraging OFWs that were affected by the pandemic to go into agripreneurship. They have allotted at least Php2.5 billion for three of its loaning programs in an effort to revive Philippine agriculture.

How to Apply

How to Apply for ANYO OFW Program | Updated on May 7, 2021

They also provided an online application platform for ANYO. You can send your application here!

With all these available agricultural loan programs, farmers, fishermen, and agripreneurs have the means to support their livelihood and boost the agriculture sector even when the pandemic is over.

Here’s How the Role of Fintech is Shaping the World during Pandemic

With most of the global population in lockdown because of the COVID-19 pandemic, people have turned to technology to achieve a semblance of their lives before the crisis.

From work from home set ups to medical innovations, technology has been a key player in keeping the economy rolling in the midst of the pandemic. One of the industries that stepped up to help the globe make sense of the pandemic is financial technology or fintech.

Role of Fintech during COVID-19: Makes social distancing easy

Photo courtesy of Toa55 via Freepik

One way to curb COVID-19’s high mortality and infection rate is social distancing. Social distancing, as recommended by WHO, means the closing down of businesses and schools, and avoiding face-to-face interactions as much as possible. The need for cashless and non-physical transactions as a way of social distancing is what makes financial technology important during this pandemic.

Most, if not everyone, utilize the power of fintech in eCommerce and online transactions. With this, they can safely obtain the things they need through online shopping and payments — all without stepping out of their homes.

Fintech serves as a bridge between the people and their needs in the time of COVID-19. Social distancing is made possible by not having to go out because what you need is being delivered to your doorstep or done on a device. As the COVID-19 cases continue to climb with no end in sight, technology plays an ever-expanding role in making sure economies and lives are intact.

Why Fintech is a tech MVP this Pandemic

Photo courtesy of Pymnts

“Just as health innovations are shaping the healthcare industry’s response to the virus, fintech is blazing trails in a socially distanced economy.”

Here are the main examples on how the role of fintech helps billions of people survive a global pandemic.

1. Household staples are a click away

Photo courtesy of Farknot by Freepik

One of the first dilemmas of the quarantined family is how to safely obtain household necessities. Stepping out of the house is dangerous, especially for those who have family members at high risk for the virus. Fortunately, eCommerce sites already have the option to shop for consumer packaged goods or groceries.

Before the COVID-19 pandemic, the grocery category in eCommerce sites faced patronage and logistics struggles; packages would be awkwardly packaged and difficult to deliver. Forbes writes that before the pandemic, the grocery category penetration would only reach 3-4%, now it has reached up to 10% because of the new normal.

2. Government aid made accessible

Photo courtesy of Philippine Canadian Inquirer

Last March, President Rodrigo Duterte signed Republic Act No. 11469 or the Bayanihan to Heal as One Act to address the COVID-19 crisis. Included in the provisions of RA 11469 is the government’s promise to provide ₱5,000 to ₱8,000 financial aid to low-income households. To augment this task, banks have stepped up to provide their digital services; a prime example of fintech in the field.

To support this effort, a group of rural banks, cooperatives, microfinance institutions, NGOs, and a payment collection company established “Damayang Sambayanihan: Hatid-Ayuda sa Kababayan” to make the distribution of cash aid more convenient in far-flung communities.

And to make the cash aid more accessible, the government also tapped e-wallet providers for cashless and contactless distribution. As of June 29, Php3.2 billion cash aid has been distributed to 455,000 beneficiaries in the country.

By using digital channels, recipients of the government’s financial support can claim the cash faster and easier.

3. Donating for a good cause

Photo courtesy of Rappler by Inkl Website

Fintech solutions like online money transfer are also very useful for individuals or groups to pool money for a good cause. Aside from government efforts, there are also non-profit organizations pitching in to help underprivileged groups survive during the pandemic.

Their efforts are made easier through the ease of information drives fund collection over digital means. Services like GCash, GoFundMe, and PayPal have been instrumental for some non-profit efforts to provide aid to less fortunate sectors.

4. Cashless bills payment

Photo courtesy of Freepik

Aside from donating and online shopping, fintech is also highly utilized in cashless transactions. Without pausing self-isolation, consumers can pay their dues using mobile wallets or debit cards.

This method of payment has been around even before the pandemic took hold, but now e-payment has seen a rise in the Philippines since the crisis began. Citizens can now fulfill payments without facing the risk of long lines at the teller.

There are other ways fintech is shaping society during this pandemic. As the demand grows for these types of technology, innovations are sure to arise. But how should fintech move forward from here? How should it position itself in a world riddled with uncertainty for the future after the pandemic?

Proper digital transformation for the future is not done overnight

Photo courtesy of Pressfoto by Freepik

Even as some healthcare companies secure victories in developing vaccines and treatments of COVID-19, this new coronavirus likewise has etched itself a seat in our future. Medical experts predict that COVID-19, like how HIV remains to be a threat, this new coronavirus is likely to never go away and that future pandemics will be deadlier.

The COVID-19 pandemic is a wake-up call of a global scale to ramp up efforts to battle future crises such as this one. Aside from prioritizing medical research and development, these efforts should include the advancement of digital technology focused on making lives easier in the midst of a crisis.

“A proper digital transformation towards a crisis-resistant world will not be done overnight. The present capacity of fintech should be strengthened and made available to more people if the population is to expect worse disasters in the next few years.”

Here are the 3 main strategies that could be done.

1. Invite the full support of the government

Photo courtesy of Municipality of Gerona Website

If financial institutions want to expand their reach to cater to more people and be able to provide more services, they will need the support of the government. The government has data and experience in serving the citizenry and would know what best steps to take in order to expand fintech capability and accessibility.

In order to create a strategy that withstands crisis and brings together the needs of companies, businesses, and consumers, the fintech industry would need the government’s help. Likewise, the government is in need of the fintech innovations that would make their financial responsibilities easier.

2. Invest in innovation

Photo courtesy of DOST Website

Technology manages to stay relevant because of the work that’s put into improving it. Fintech is already a very innovative industry right now but if in 10 years it hasn’t changed, it will surely lose its users.

Fintech trends are ever-improving; all in the name of making financial services easier. Expect that in a post-pandemic world, the fintech industry will play a bigger role in boosting the economy after the devastating market crashes it had to endure during the COVID-19 pandemic. The best way to keep up with that overwhelming responsibility is to invest in research and innovation.

3. Consider the broadest range of stakeholders

Photo courtesy of Tirachards via Freepik

“Another way for the fintech industry to contribute to the digital transformation of the post-pandemic world is it sets its eyes on a broader horizon. This means expanding its accessibility towards the underprivileged sectors.”

As showcased by the logistical challenges of providing aid to low income families, fintech solutions are needed more than ever to bolster efforts like these. The fintech industry has the technology to reach farther and deeper than what they have reached prior to the crisis. It only needs to reorient its business goals to serving a wider range of the population to support the efforts against the pandemic.

The future remains uncertain for a world that fights COVID-19.

“What remains for policymakers and industry leaders is to learn how to innovate technology to curb the damage to the economy and serve the whole of society.”

Being a crucial player in this battle, the role of the fintech industry has an enormous responsibility in making sure the war against the pandemic is won.

AMID COVID-19: Fintech Startup pushes for Online Rural Banking

This was originally published by Malaya Business Insight

Due to social distancing protocols brought on by COVID-19, digital financial services have evolved from being a nice-to-have to an essential service.

Sparky Perreras, CEO of PearlPay, however, said that while commercial banks have been able to quickly pivot to digital banking services, many Filipinos in remote areas of the country rely on rural banks with no digital infrastructure.

PearlPay is a fintech startup that provides end-to-end digital banking solutions to local rural banks.

“There are 450 rural banks in the Philippines, combining for 2,745 physical branches. 97 percent of those are in far-flung areas where commercial banking does not exist,” Perreras said.

“Almost all of these rural banks don’t have ATMs, debit prepaid cards, let alone mobile banking.”

Perreras said the challenge for rural banks is the high cost needed to set up a digital platform.

But thanks to cloud technology, PearlPay is now able to help these banks digitize their services, enabling them to reach and serve even those with limited or no access to the internet.

“Gaining access to world-class digital infrastructure is not exclusive to big companies anymore. Cloud technology democratizes access to computing resources and it’s a great equalizer in today’s economy, ensuring that even small rural banks in the Philippines can participate and thrive,” said Perreras.

PearlPay uses AWS cloud to reduce the data center footprint of rural banks.

This means migrating over 450 data centers from on-premise to AWS cloud. Additionally, the company will be migrating over 200 core banking solutions to the platform.

“By setting up our own data center, we wouldn’t be able to offer our software-as-a-service,” Perreras said.

“That’s the beauty of using a cloud service like AWS.”

For many fintechs, perhaps the biggest benefit of the cloud is the ability to innovate to drive financial inclusion.

In fact, the lower cost for PearlPay’s core banking solution is already a business model innovation that improves access to financial services.

But unlike other fintechs, PearlPay is primarilytargeting rural banks instead of the end-users.

According to Perreras, the purpose of this is two fold—many Filipinos in rural areas do not have smartphones and regular access to the internet and because many are still afraid of online banking.

“The number one challenge of fintech is trust,” Perreras said. “And rural banks already have the trust of the local community.”

He noted that because the unbanked usually get their financial services from informal lenders, they also have limited experience with actually dealing with banks.

PearlPay’s Agent Banking Solution (ABS) aims to solve this consumer behavior, as it enables authorized employees to go directly to end users to provide banking services outside of the bank.

With a bank-mandated agent and an ABS device, banks can collect payments, onboard customers, and expand customer beyond their physical infrastructure.

This allows rural banks to educate and introduce the unbanked to formal banking services, as well as to financial technology solutions like mobile wallets and digital payments.

In these challenging times, inclusive financial services have never been more important.

“Everyone wants to gain access to cash, to local remittance, to the social amelioration program of the government,” Perreras said.

“And with cloud technology, PearlPay and rural banks can do more and reach more.”

Supporting Farmers and MSMEs: Economic Development during COVID-19

Micro, Small, and Medium Enterprises (MSMEs) and agriculture remain as the backbone of the country even during the COVID-19 pandemic.

“They play a significant role in economic development with MSMEs making up 99.52% of businesses in the country while the agriculture sector secures the country’s food production and supply.”

However, the pandemic heavily impacted the agriculture and business sector. This resulted in MSMEs closing down while farmers are having trouble delivering their harvests, resulting in loss of income.

But how much has the pandemic affected these sectors? And what can we do to support them?

The Impact of COVID-19 on MSMEs

Photo courtesy of We The Pvblic

The role of MSMEs contributes significantly in Philippine employment. According to the latest List of Establishments from the Philippine Statistics Authority (PSA), there are 998,348 MSMEs in the country with micro and small enterprises placing 2nd and 3rd in employing labor force nationwide.

The Employment Scale of MSMEs in the Philippines

However, MSMEs are affected more heavily than other businesses. The imposed community quarantine resulted in lack of income, becoming unable to support their business and employees.

“Trade Secretary Ramon Lopez announced that 52.66% of MSMEs closed down during the online meeting of the House Defeat COVID-19 committee’s social amelioration cluster last May 1.”

This means that more than 525,000 MSMEs are affected, resulting in millions of people left unemployed and no source of income.

Helping MSMEs in the Philippines

Photo courtesy of ABS-CBN posted on Panay News Website

To help cushion the impact of the 2019 coronavirus, the government has launched several programs and initiatives to help MSMEs recover from the pandemic.

One such program is the Enterprise Rehabilitation Financing Facility under the Pondo sa Pagbabago at Pag-asenso (COVID-19 P3-ERF) provided by the Small Business Corporation of the Department of Trade and Industry (DTI).

It’s a P1-billion loan facility where micro-enterprises with an asset size of not more than P3 million may borrow P10,000 up to P200,000 thousand while small enterprises with an asset size of not more than P10 million may borrow a higher amount not exceeding P500,000.

DTI P3-ERF P1-billion Loan Facility

There’s also the Small Business Wage Subsidy dedicated to affected employees of small businesses. They can receive a wage subsidy worth P5,000 to P8,000 for 2 months so that these businesses can retain their employees during the lockdown period.

The Importance of Agriculture During the Pandemic

Photo courtesy of AvianQuest posted on Panay News

The pandemic urged countries to close their borders, halting the export of goods. This initiated the need to improve agricultural production to ensure food supply.

The importance of farmers is highlighted more clearly now that the Philippines can no longer rely on imports in supplying food to millions of people.

The Department of Agriculture (DA) reported that farmers sold an estimated worth of P1.6 billion of agricultural products to 245 local government units (LGUs) for their food relief packs, a healthier alternative from canned goods.

Agricultural produce for LGU food packs

But farmers are also heavily affected by the pandemic.

Many farmers have experienced difficulties in taking their produce to the market due to the temporary suspension of public transportation, closure of some trading posts, and the tightening of borders following the transportation guidelines of the community quarantine.

Improving Philippine Agriculture

Photo courtesy of Chris Stowers/Panos of SciDevNet

To solve such problems, the government has taken the necessary measures to allow unrestricted movement of agricultural produce and has dedicated a budget to boost the agriculture sector in light of the current situation.

The Inter-Agency Task Force on Emerging Infectious Diseases (IATF-EID) approved a P31-billion supplemental budget to fund the DA’s “Plant, Plant, Plant” Program, also called ‘Ahon Lahat, Pagkaing Sapat (ALPAS) Kontra sa COVID-19,’ to address the country’s food sufficiency needs.

Breakdown of Department of Agriculture’s P31-billion Supplemental Budget

Aside from that, the government has also provided financial help to farmers in the form of cash aid and loan programs.

They launched the Rice Farmer Financial Assistance (RFFA) and the Financial Subsidy to Rice Farmers (FSRF) where small farmers can claim one-time cash assistance of P5,000 from government-owned banks and authorized financial institutions such as rural banks and other organizations.

List of Authorized Organizations to distribute RFFA and FSRF

As an agricultural country, the Philippines is in a good position to ensure food security even during the pandemic. Filipino farmers are working to ensure that Filipinos can have access to fresh produce.

But how can the government distribute their financial help programs, especially to those in far-flung areas?

Utilizing Rural Banks to Support Farmers and SMEs

Photo courtesy of TongStocker via Freepik

Rural banks, along with cooperatives, microfinance institutions, non-governmental organizations, and payment collection companies, signed a memorandum of understanding called “Damayang Sambayanihan: Hatid-Ayuda sa Kababayan.”

This MOU serves as another way to distribute government subsidies faster. According to RBAP President Roberto Abello, they are ready to utilize their massive rural bank network of over 2,700 branches nationwide to handle the countryside pump priming needed to address this global pandemic and local quarantine.

And since rural banks are scattered throughout the country, they make it easier for Filipinos to receive the much needed cash support. Farmers can easily claim the RFFA and FSRF from the nearest rural bank without having to travel far.

Aside from that, rural banks also provide agricultural and business loans, catering to the financial needs of Filipino farmers and MSMEs.

Digital Banking for Economic Development

Photo courtesy via Freepik

The COVID-19 pandemic has shown the need to go digital, particularly in rural communities. Banks continue to play an important role even with the community quarantine in place, which is why the need to digitize the rural banking industry is seen more clearly than ever.

With their expansive reach in the countryside, Filipinos, farmers, and MSMEs can easily access financial services. Through digital banking, they can get access to the necessary funds that they need to support and grow their livelihood, encouraging economic development in rural areas.

![A New Decade of Digitalization | Part 2 [INFOGRAPHICS]](https://sandbox.pearlpay.com/wp-content/uploads/2020/07/A-New-Decade-of-Digitalization-Part-2-Infographics-uai-258x139.jpg)