Digitizing Rural Banks: The Solution to Philippine Financial Inclusion

According to the 2017 Global Findex, a staggering 69 percent of Filipinos have no current and existing bank account. Compare that to the 105-M population of the Philippines that means 73,500,000 remains unbanked. That’s worse than the average rate in developing economies of 46 percent and far worse than the global average of 38 percent.

Photo courtesy of Doucefleur via Freepik

Photo courtesy of Doucefleur via Freepik

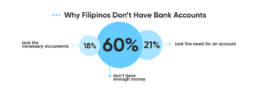

In a survey conducted by the Bangko Sentral ng Pilipinas (BSP) last 2017, 60% of respondents cited poverty or not having enough funds and cash-on-hand as to why they don’t have a bank account. Reasons then followed are the perceived lack of need for one (21%) and a lack of necessary documents (18%).

The absence of bank accounts limits the opportunities Filipinos have. When zoomed in to the situation, this means no capability to support further study of children, no money in case of any medical emergency, and no money to invest and grow on their own.

That is why many Filipinos still rely on the age-old method of saving money at home. Placing extra cash on their alkansya and participating in other forms of informal savings and investments like hulugan and paluwagans, etc.

This situation alone paints a picture of the current state financial inclusion in the Philippines.

Rural Banks as Unsung Heroes of the Banking System

Photo courtesy of Wikimedia, Business Mirror, Ipinimg and Rural Bank of Dulag

If we want inclusive growth in the Philippines, we need to start bringing more opportunities to the countryside and far-flung places. Enter rural banking in the Philippines.

“Rural banks in the Philippines show great potential in becoming a catalyst for financial inclusion in the country.”

With the combined help of the government and the Rural Banking Association of the Philippines, we can make rural banks more relevant and accessible to all Filipinos.

Governor Nestor Espenilla, Jr. has even said it himself in his speech for RBAP’s 65th Annual Convention:

“Rural Banks are the #LODIs for Financial Inclusion.”

A coin termed by Filipino millennials, which means “IDOL,” this takes of RBAP’s 2018 theme of “Leading Onwards to Development and Inclusion #LODI.” Showing the willingness of the organization to reposition itself to serve the growing needs of a new breed of financial customers.

He said, “Rural banks have proven themselves to be LODIs in their own right… [they] may be smaller in size compared to commercial and even thrift banks. Still, they have proven their mettle and invaluable contribution to countryside development through the financing of rural communities.”

With RBAP’s extensive network of 2,745 banking offices nationwide, the industry is seen as a catalyst for greater financial inclusion. With the provincial network of almost 97 percent, rural banks can serve more Filipinos and provide financial education, protection, and of course, inclusion one needs. One in every three banking offices located in the Davao Region and Mindanao is a rural bank—a testament to how far we can go with Philippine rural banking.

The role and importance of rural banks in the Philippines are to promote and further expand the rural economy by providing Filipinos in rural communities with essential financial services like creating bank accounts, giving rate-friendly loans, and setting Filipinos up for financial protection in the long-run.

Rural Banks Rooting for the PH Agricultural Sector

Photo courtesy of Thannaree via Freepik

The rural bank’s focus is our fellowmen in the Agriculture industry. AAMBIS-OWA Party-list Rep. Sharon S. Garin said it herself, “The agriculture sector is said to be the second-largest generator of employment in the country. Workers from agriculture sectors are also among the poorest citizens,”

That is why the call for rural banks in the Philippines to become more active and present is stronger than ever. Our rural banks can provide the much-needed capital to boost agriculture activities and empower them by helping farmers and fishermen through their stages of production. From the beginning process of buying seedlings and the necessary equipment to assist in the marketing of their produce.

Rural banks are not just giving financial means to Filipinos, but providing the necessary monetary aide for them to do their work better.

The Roadblocks to Financial Inclusion

Photo courtesy of Skawee via Freepik

The current working situation of rural banks and the agriculture sector wasn’t always like this. It was intended to be, but it was not pulled through successfully.

Back in the ’70s, rural banks offered loans at low-interest rates to boost economic productivity in the countryside by providing credit for rice, corn, fisheries, and many other agricultural production programs.

As rural banks grew in number in 1981, less money was being made available to those who were meant to benefit from them. The situation turned sour as the government was ready to call it quits on the program when the funds were not distributed to the right people. Farmers and fisherfolks were complaining they could not get loans intended for them, thus settling on informal lenders with higher interest rates.

A rural bank rehabilitation program was adopted, the Rural Banks Act of 1992, aimed at nursing back ailing rural banks that left about 500 rural banks in the Philippines. Fewer in number, but more heavily regulated and empowering to the community.

Rural Banking to go Digital

With better bank operations and conditions, people in towns and barrios can now trust these banks with their money and their future.

With the trust in rural banks re-established, it’s time for these establishments to leverage the benefits of technology and bring more Filipinos into the formal financial system, especially those in far-flung areas that larger firms cannot serve.

Going back to Espenilla’s speech, “… it is crucial for the [rural banking] industry to leverage innovative technologies… [to] further expand market reach and enhance existing service delivery channels in rural areas.”

With the digital transformation of the banking system, the rural banking industry serves as a dependable and robust delivery channel in the provision of banking services. We are counting on our rural banks to assist in further bringing about economic progress to the rural communities.

Innovations enabled by digital technology can not only make agri-financing more viable but also unlock new opportunities for rural banks to deliver a whole range of financial services catering to the unique needs of farmers and their communities.

Tapping these opportunities can evolve rural banks into valuable full-service community banks – a true pillar of countryside development.

PearlPay Solution: Digitizing the Rural Banking System

In line with Espenilla, PearlPay believes that through digital, we can further improve the state of financial inclusion through our rural banking system. With the Bangko Sentral ng Pilipinas’ (BSP) mandate to embrace digital, part of PearlyPay’s mission is to provide quality and affordable solutions that will aid rural banks in their digital transformation. In results, our efforts will yield universal financial access and services to the unserved and underserved Filipinos in remote and far-flung areas.

PearlPay partners with Rural Banks in Pangasinan

Originally published by The Manila Times

Financial technology startup PearlPay has signed a strategic partnership with the Association of Pangasinan Rural Banks (APRUB) as part of its push to enable financial institutions to be more commercially competitive through digital transformation.

The agreement was signed during the 62nd Charter Anniversary Symposium of the Rural Bankers Association of the Philippines at the Manila Hotel. It allows 16 member banks of APRUB to access PearlPay’s end-to-end cloud-based banking solutions, namely Core Banking Solutions, Agent Banking Solutions, and white-label e-wallet solutions.

“Rural banks have proven to be important vehicles in the overall development of the Philippine economy as they cater to the financing needs of farmers, fisherfolk, and rural communities for financial inclusion,” Spark Perreras, co-founder and CEO of PearlPay, said.

“As a fintech company, one of our core goals is to empower these institutions with digital solutions that allow them to streamline processes, scale operations, and reach customers.”

PearlPay’s end-to-end banking solutions, which use Amazon Web Services (AWS), will enable rural banks to improve and grow their capabilities so more people can enjoy convenient and affordable access to financing services.

“PearlPay believes that all Filipinos should have access to world-class and up-to-date technological solutions that will help them save time, money, and connect better to their loved ones,” Perreras added.

According to the Financial Inclusion Survey of the Bangko Sentral ng Pilipinas (BSP), approximately 77.4 percent of the Filipino population remains unbanked. Perreras describes this as a basic indicator of the current state of financial inclusion in the country and believes fintech solutions could go a long way in bridging this gap.

“Our range of products and services are designed to address the very reasons why Filipinos remain unbanked or underbanked, such as expensive fees, reliance on the internet or latest mobile device and software, and lack of providers with solutions specifically tailored to address these problems,” Perreras said.

PearlPay also signed a pilot program agreement with Dagupan City-based provincial bank BHF Rural Bank, Inc., also a member of APRUB.

Fintech targets Underserved Rural Banking Sector

Originally published by Manila Bulletin

A fintech startup and mobile wallet enabler are set to begin a pilot test program for a new generation of cloud-based financial services set to be launched in the country.

PearlPay has signed a pilot program agreement with BHF Rural Bank, Inc. (BHF), based in Dagupan City and operating in seven branches. The agreement marks the first time a Philippine rural bank will utilize cloud-based technologies such as core banking solutions (CBS), agent banking solutions (ABS), and white-label eWallet solutions, all of which are designed to reach customers with limited or no access to the Internet.

“Previously, it was nearly impossible for rural banks to become part of the e-money landscape. The foremost concern is, of course, cost. It’s too expensive and risky for us. PearlPay will help us solve that challenge,” said Armando Bonifacio, President of BHF Bank

Bonifacio cited PearlPay saying the startup’s framework gives them the much-needed jump to pursue its digital transformation.

“This will allow us not only to offer better and high-quality services to our customers but also to become an excellent example of what rural banks could achieve given the right partners and resources,” he said.

“PearlPay is one of, if not, the most promising enablers out there,” he added.

For his part, PearlPay CEO Spark Perreras noted the millions of Filipinos who still remain unbanked or underserved.

“While this remains a challenge for economic growth, it also presents an opportunity for organizations to tackle the problem. In the previous survey of the Bangko Sentral ng Pilipinas (BSP), only around 23 percent of Filipinos have access to formal financial products, and PearlPay aims to improve the economic inclusion rate in the Philippines,” said Perreras.

As much as 94 percent of Philippine rural banks do not have access to electronic money.

“This is what we mean by ‘underserved.’ The rural bank customers don’t get the same services as what customers get in the major cities. Instead of doing convenient online banking to pay bills, they need to line up for hours to withdraw funds and pay their bills,” he said.

The startup is an end-to-end solutions (E2ES) provider for financial institutions.

End-to-end solutions mean providing application, software, system, and hardware requirements of the customer, such that the customer won’t need to source out other providers to achieve his or her requirements.

“As a mobile tech wallet enabler, PearlPay will not compete with banks. Instead, it will actually enable institutions in the Philippines like rural banks, schools, pawnshops, sari-sari stores, gasoline stations, and other micro, small and medium enterprises (MSMEs)” said Perreras.

The pilot program is set to last for 12 months.

Unbanked but Mobile Literate Population

The Philippines recently claimed the top spot in the list of the ‘Best Countries to Invest In’ released by the US News & World Report this 2018. Thanks to the steady inflow of foreign direct investments (FDI) to the country, the country won the top spot despite the overall decline in the Southeast Asian region last year. Along with this, the latest Consumer Finance Survey (CFS) conducted by Bangko Sentral ng Pilipinas (BSP) projected a significant increase in the country’s labor force over the next 10 years, benefiting from a relatively large number of young adults compared to the population reaching retirement age.

While these are key indicators of the country’s rapid economic growth, the survey also garnered a rather contradicting statistic – a stark majority of Filipino households or 86% is unbanked. More specifically, according to the latest data on financial inclusion from the World Bank, around 65.5% of Filipinos 15 years old and above currently do not have a formal bank account.

Most people residing outside the National Capital Region still have limited to no access to banking and financial services due to several factors. The foremost reason for not having a deposit account is the lack of funds, noting the expensive service fees and high maintaining balance required to keep an account. Most of the unbanked population are either self-employed or working in the informal sector, wherein earnings are most likely given in hard cash rather than wired through formal channels.

In addition, these people no longer acknowledge the need for a savings account because their salaries are all spent on their day-to-day needs. In remote rural areas, the nearest bank branch is usually located miles away in the city or town center, and the distance would only make it more difficult to retrieve their money in case of emergencies.

Opportunely, the presence of an advanced mobile market and a high level of interest in technological advancement make the Philippines highly adaptive to innovative solutions that will potentially expand financial services to the unbanked population and beyond.

Digitally-Active Population

As revealed by We Are Social and Hootsuite in their “Digital in 2018” report of social media and digital trends worldwide, more than half of the Philippines’ population is now online; with 67 million Filipinos (63%) having access to the internet, all of which are active on social media, primarily Facebook. From this count, 62 million (59%) use mobile social networking applications, whereas 61 million (58%) currently own a mobile gadget. Based on these numbers, it is highly likely that an unbanked person would own a cellphone, have access to the internet, and avail of many different services available.

Aside from messaging and social media, mobile devices now support e-commerce activities, wherein a total of 33.81 million people were able to purchase goods from online stores, among which 25% of the population were able to make an online purchase just using their smartphones. In just a year, the total revenue garnered from the e-commerce market has reached 1.237 billion USD. This is a remarkable feat due to the fact that only 3% of the population has a credit card which is one of the ways to make online payments.

Open-Minded Attitude towards Digital Inclusion

Filipinos generally have a positive outlook on the role of technology in their daily lives. Out of the population of internet users in the Philippines, 74% believe that new technologies offer more opportunities than risks, and 64% prefer to complete tasks digitally whenever possible. They are more likely to embrace new technologies that make use of available resources and target pain points in the current system. This is the reason why online shopping sites, electronic payment systems, and transport network vehicle services are now booming businesses in the Philippines.

Based on these stats, the potential for using blockchain-based mobile wallets like PearlPay stands a good chance for adoption since it provides people with more options to facilitate fast and secure payments without having to go to the bank or transacting through other costly formal channels.

In sum, the Philippines’ youthful, mobile-literate population and financially-attractive economy create a perfect environment to develop innovative solutions aiming to spread equal opportunities for growth and inclusion for all Filipinos in every region. With PearlPay, the Philippines is looking at a future not only as of the “texting and social media capital of the world” but soon to be the “mobile payment capital of the world.”

The Plight of OFWs: We need a Better Way to Send Money Home

Since the turn of the 21st century, the Philippines has actively played a part in the global labor market. Seeing the promise of a bigger income through earning foreign currencies has enticed millions of Filipinos to choose employment overseas. At present, around 12 million Filipinos or at least 10% of the country’s population are now classified as Overseas Filipino Workers (OFWs). Despite the harsh environments, bouts of homesickness, and even life-threatening risks that they knew they would face abroad, their desire to provide a better life for their families is even greater. Through sending their hard-earned salary back home, OFWs are able to strengthen their bond with their families and help them withstand struggles with great resilience.

Not only this, they have become one of the backbones of the Philippine economy. According to the World Bank (WB), OFW remittances as of 2017 have amounted to a record-high 33 billion USD, placing the Philippines at 3rd rank among countries with the highest remittance inflows. As the 2nd largest source of foreign exchange, OFW remittances play a huge part in propelling the Philippine economy and peso currency.

Remittances reach their dependents through formal channels such as banks and money transfer agents, as well as personal couriers, who may be family members or co-workers bringing the cash and non-cash items back home to the Philippines. As announced by the Bangko Sentral ng Pilipinas (BSP), remittances sent through formal channels such as banks and money remittance agents nationwide have increased by 4.3%, while personal remittances grew by 5.4% in just a year.

As much as these figures indicate a significant contribution to the country’s economic growth, the ways of sending money from abroad pose several challenges to both the sender and receiver. As reported by World Bank at the 1st quarter of 2018, the global average cost of sending money through banks is at 7%, which escalates to as high as 11% to send money to the Philippines. In most cases, OFWs would have to shoulder expensive bank fees just to send the exact amount of money intended for their family’s needs. Further alarming is that some commercial remittance companies even charge hidden fees between 2.5% to 4% depending on the method of transfer used. In terms of the length of time needed to send money, it may take as long as 3 to 5 days to process international wire transfers. This means that in unexpected times of need, a family would have to wait almost a week to receive emergency funds, and in the case of dependents living in communities farther away from the city, the wait would be even longer. If faster and safer transfer translates to a higher cost to pay, what choice is there left for our OFWs?

As proposed by Dilip Ratha, lead author of the World Bank Remittance Report 2016, governments should start addressing the need to reduce costs and simplify the process of sending money home through the use of more efficient technology. Most fortunately, we are living at a time where the latest advancement in technology is taking center stage, especially in the financial sector.

Today, blockchain continues to make headlines in the financial services industry. Known as the platform that powered Bitcoin and other cryptocurrencies, the tech community is now looking into the potential of blockchain to power innovation in the financial industry. By definition, the blockchain technology is a distributed database with information duplicated across a network of computers. Transactions are recorded into the database as blocks and verified by all members of the network. The chain of blocks is protected by cryptography, which ensures that anything recorded in the database can no longer be removed or forged. The blockchain database is built to be free from control by a single entity, and to have virtually no single point of failure, thus ensuring transparency and incorruptibility as the foremost features of the system.

From the words of Vitalik Buterin, Ethereum inventor, “Blockchain solves the problem of manipulation. When I speak about it in the West, people say they trust Google, Facebook, or their banks. But the rest of the world doesn’t trust organizations and corporations that much. It’s not about the places where people are really rich. Blockchain’s opportunities are the highest in the countries that haven’t reached that level yet.”

They say, people often overestimate what technology can do within 2 years but largely underestimate what it can do in 10 years. Harnessing the potential of blockchain technology to eradicate the limitations of existing financial systems, we proudly introduce a breakthrough solution designed to revolutionize the way we send and receive money.

Pearl Pay is a Philippine e-banking platform that will provide world-class and affordable financial services to Filipinos, including domestic/international money remittance, cryptocurrency exchange, and innovative payment solutions. Using just a smartphone connected to the Internet, Pearl Pay makes it possible to have affordable banking transactions done right in the palm of our hands, anytime and anywhere. It also seeks to give more to the Filipino people by reducing the costs of money transfer and ensuring that even the **“unbanked”** can send and receive money as fast and safe – anytime and anywhere.

With Pearl Pay, we can put the Philippines back on the map not just for knowing how well selfie works but by empowering our fellow citizens to connect more to do more.

![Digitizing Rural Banks: The Solution to Philippine Financial Inclusion [INFOGRAPHICS]](https://sandbox.pearlpay.com/wp-content/uploads/2020/02/Digitalizing-Rural-Banks-uai-258x140.jpg)