The Silver Lining: Emerging Markets and Digitalization during COVID-19 Pandemic

Uncertainty is the word to best word describe the current situation now with the coronavirus outbreak.

The pandemic has impacted almost every part of the economy, which has already seen companies furlough employees, close stores, and miss out on funding. People don’t know when they’ll be able to freely go out of their homes. Some don’t know if they have jobs and opportunities still waiting for them after this pandemic. But one thing is sure, people aren’t sure how everything will pan in the next couple of days.

With people stuck in their homes, schools have stopped classes, and some companies are experiencing a phase of stagnation, has this become the new “normal” for us?

It’s easy to wallow onto the dark side of things when everyone is struggling. But if we dare to look closely, we will see there is a silver lining too—an opportunity to adapt and innovate as we utilize digitalization for COVID-19.

The Pandemic Era pushing us closer to Digitalization

Photo courtesy of Nuttawutnuy from Freepik

The pandemic might have affected all of us. But it’s bringing light to the one thing we all need to adapt: digitalization.

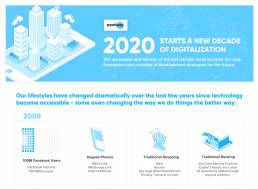

Going digital was only once an option. For banks and financial institutions, digital payments and options were only born for the convenience of users. But now that everybody is locked inside their homes, it seems like digital is now a necessity at this point.

There might still be a number of people who will be reluctant and still go for cash. Who wouldn’t blame them? Cash is still king in grocery stores, pharmacies, your corner coffee shop, and your every-reliable sari-sari store.

How can you convince a person, who’s transacted everything in his life through money, to go digital? This is where FinTech startups come in.

Fintech startups are doing the important work of making sure the most vulnerable among us continue to have access to services they need through this pandemic using a digital innovation strategy.

As the fintech sector struggles through the COVID-19 economic fallout, a report from VC Finch Capital offers some light at the end of the tunnel, suggesting that the crisis could ultimately end up benefiting the industry by accelerating the rush to digitalization.

Even Radboud Vlaar, managing partner, Finch Capital, says: “2020 will be challenging for fintech to navigate, but there are better times ahead. Post-crisis, disruptive winners will ‘take all’, as we expect surging demand from financial services for technology to master digital-only interaction, enabled by AI and big-data analytics.”

Who would’ve thought that a pandemic era would push us towards a long-time mission of digital innovators? COVID-19 has reframed how society behaves, making digital-only the new norm for all types of services, especially financial.

Benefits of Going Digital and Cashless

Photo courtesy of Jonas Leupe from Unsplash

There are plenty of benefits to going cashless: digital payments are convenient and are now necessary for us to live in our “new normal.”

Financial experts even say that digital innovation will boost financial inclusion, as more and more individuals are able to open bank accounts online and transact digitally without ever having to enter a physical bank branch – difficult at times like this in most developed economies, almost impossible for rural populations in emerging markets that live far from their nearest town or city.

Digitalization for COVID-19: The Transition from Cash to Cashless

Photo courtesy of Daniel Döderlein via Forbes

Cash to a cashless society isn’t all that straightforward.

Online payments may seem easy enough, but there is still a lack of standardization in the system that delays payments and creates bottlenecks. This is one hindrance that is keeping people away from moving to digital.

This is what Fintech startups are aiming to solve. Providing accessible digital infrastructure to financial institutions like rural banks makes the transition easier not just in urban areas but also in rural communities.

However, one key barrier that must be addressed is trust. Did payment go through accurately? Through innovation, banks can make a friendlier, more convenient process that is easily understood by consumers.

When a transfer is done, both consumers and merchants could receive an alert message. At the end of the day, merchants could get a summary of their daily takings. Digital solutions not just enables easier operations for banks and merchants but also allows them to provide a better experience to customers. Such value-added services will further encourage merchants to start their digital transformation even through the pandemic.

Digitalization for All

Photo courtesy of Bignai via Freepik

The importance of digitalization is seen more clearly than ever with the rise of COVID-19. Businesses are promoting their online and digital platforms so that the public can still have access to goods and services, and banks are no exception.

Filipinos, especially those in the most vulnerable areas, can access banking services and receive government assistance faster, no longer having to worry about being able to meet their day-to-day needs.

With digitalization, Filipinos can better sustain themselves and be more resilient in the long run.

Top 7 Fintech Startups in the Philippines for 2020

This was originally published by Fintechnews Philippines

Photo courtesy of Fintechnews Philippines

Last year, Manila was named one of the world’s friendliest cities in the world for fintech startups and was recognized for its strong English-language skills and well-established outsourcing industries.

Fintech companies already compose 15% of Manila’s startups, according to Startup Genome’s Global Startup Ecosystem Report, and the market is expected to grow from about US$5.7 billion in 2018 to US$10.5 billion by 2022.

The Philippines’ fintech industry is expected to continue growing in 2020 on the back of memorable developments and deals in 2019. The following are seven fintech startups in the Philippines which made significant strides last year and are now poised for recognition.

Tonik

Founded in 2018, Tonik is a startup headquartered in Singapore that’s building the first digital-only bank in Southeast Asia. Tonik’s offering will be focused on providing banking products that fit seamlessly into the lifestyle of customers with simple consumer payment, savings, and borrowing solutions delivered through a smartphone.

Tonik received its banking license from Bangko Sentral ng Pilipinas, Philippines’ central bank, in January, which makes it technically the first digital bank in Southeast Asia and one of the very few globally to be operating on the basis of its own bank license.

The startup raised $6 million in February and will be launching operationally later this year in the Philippines. Tonik’s support and research and development (R&D) functions are based in Singapore and Chennai, India.

MarCoPay

MarCoPay is a venture established in mid-2019 by the Japanese shipping firm NYK Line and its local partner Transnational Diversified Group (TDG). The company provides an electronic money platform designed mainly for seafarers hired outside Japan. The app utilizes QR codes that can be used for completing pre-boarding procedures, receiving and converting salaries into digital currency and spending this e-money for onboard purchases.

The company received its e-money license in December 2019 and is currently operating its app in beta. MarCoPay is preparing for a full launch, which will focus mainly on allowing seafarers and vessels’ masters to make electronic money transactions aboard their ships, including sending money home to their families and will include value-added features anchored on its digital currency such as enabling digital purchases in ordinary stores and giving out discount coupons.

PhonePera

PhonePera, which means Phone Money in Tagalog (Filipino Language), aims to transform the lives of millions of Filipinos who do not have access to conventional banking services. An e-wallet product of AiPayGo, a fintech company under the incubation program of Republisys, PhonePera will be designed for people at the bottom of the socioeconomic ladder, those who don’t have access to bank accounts or a simple debit card.

PhonePera was unveiled in late-2019 by founder Randy Prado, a mobile tech veteran who previously held positions at Nokia Australia/NZ and Portitech (Portable Internet Technologies). In an interview with Inquirer.net, Prado said that he envisions PhonePera being the first mobile payment technology developed in the Philippines expanding globally to the huge Filipino communities and foreign workers deployed around the world in Australia, Europe, North America, and other neighboring Asian countries.

SeekCap

SeekCap is a new online lending platform launched in November 2019 by UnionBank’ fintech arm UBX and Ping An’s associate firm OneConnect Financial Technology. SeekCap aims to drastically shorten turnaround time relative to traditional loan applications. The company’s platform and technology can approve a loan the very same say as application and disbursement is done within three.

SeekCap targets the Philippines’ underserved micro, small and medium enterprises (MSMEs) community, which constitutes more than 99% of all businesses in the Philippines and contributes 63% of total employment.

PearlPay

Founded in 2018, PearlPay is a fintech startup and mobile wallet whose mission is to help financial institutions, especially rural banks, be commercially competitive with access to the latest and innovative banking solutions. PearlPay aims to become the national digital payment enabler and gateway in the country by providing quality and affordable banking solutions to financial institutions and individuals previously underserved.

PearlPay grew significantly in 2019. The company signed a pilot program agreement with BHF Rural Bank to test a new generation of cloud-based financial services set to be launched in the Philippines, and expanded to Hong Kong and Indonesia.

PayMongo

Founded in 2019, PayMongo is a new payments processing startup that allows merchants and MSMEs to accept credit cards, e-wallet and over-the-counter payments.

PayMongo raised US$2.3 million in a seed funding round in October from investors including Stripe, PayPal’s co-founder Peter Thiel, and Y Combinator. The startup said at the time that it had recorded transaction growth at an average of 116% week-over-week.

In January, PayMongo teamed up with Globe Telecom’s mobile wallet GCash to expand its payment options. It said that it had onboarded some 3,500 merchants onto its platform.

PayMaya

PayMaya, a subsidiary of Voyager Innovations, is a mobile money and payments company that provides various financial services including a prepaid online payment app, merchant payment solutions, e-wallet services, and remittances services.

Last year, PayMaya expanded its loading network to 27,000 channels nationwide, including banks and a fintech partner, and in February of this year, it partnered with the city government of Manila to roll out the PayMaya citizen ID cards to its residents. The cards will be used for the distribution of cash benefits from the local government and residents will be able to utilize it to purchase goods from the city-managed Kadiwa stores, which are equipped with card and QR code payment systems powered by PayMaya.

The same month, the Bureau of Internal Revenue (BIR) officially welcomed PayMaya as a new digital channel, enabling individual taxpayers to use the PayMaya mobile app to settle their tax payments.

COVID-19 Health Benefit Packages: Medical Assistance for Filipinos (UPDATED)

Because of the current public health crisis, Filipinos, especially those in the vulnerable sectors, need proper medical care to ensure their safety. Developing COVID-19 health benefit packages can help everyone get the necessary treatment without having to worry about the costs.

Under the Universal Health Care Law, which was passed last February 2019, all Filipinos are automatically members of PhilHealth and are immediately eligible to avail of the benefits. “This is part of PhilHealth’s mandate to ensure that all Filipinos have equitable access to quality, affordable and accessible health care services,” said Health OIC-Undersecretary Maria Rosario Vergeire during the Beat COVID-19 Virtual Presser.

So what are the health care packages available for Filipinos during the coronavirus outbreak?

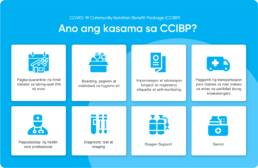

COVID-19 Community Isolation Benefit Package (CCIBP)

One of the COVID-19 health benefits packages is CCIBP. Under the PhilHealth Board Resolution No. 2516 series of 2020, Filipinos can avail of benefit packages for health services, including community-based isolation. It’s financial assistance for probable and confirmed patients being quarantined and treated at community isolation units (CIUs), including Local Isolation and General Treatment Areas for COVID-19 cases (LIGTAS COVID) centers and Mega LIGTAS COVID Centers.

What does it cover?

What does CCIBP covers?

The medical aid package covers all identified services needed by Filipinos to effectively manage cases needing isolation services based on applicable guidelines adopted by DOH. All treatments and activities done during the patient’s stay in the CIU, such as payment for staff and professional fees, medicine, diagnostics, transport, and other operational costs, are included.

According to the PhilHealth Circular No. 2020-0012, confirmed and probable patients with manageable symptoms and staying at accredited CIUs can get a maximum reimbursement rate of Php 22,449. This will be implemented this coming May 11. However, CIUs that already provided isolation services on February 1 can file a claim as long as they meet the DOH accreditation requirements.

Who can avail CCIBP?

Who can avail CCIBP?

All PhilHealth members can avail the health benefit package. Members who have missed contributions are still qualified to avail the CCIBP. For those who are not yet PhilHealth members, just fill up the PhilHealth Member Registration Form (PMRF) and present 2 valid IDs.

List of Valid IDs

Updated Case Rates

Based on Circular 2021-0014, PhilHealth also provided an inpatient benefit package for Filipinos with positive RT-PCR test results and an intermediate package for patients who were initially assessed as having COVID-19 but had negative test results.

PhilHealth Updated Case Rates

Just like the COVID-19 Community Isolation Benefit Package, this will cover all the necessary treatments for the patients.

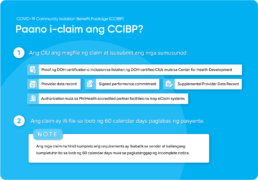

How to Claim the COVID-19 Health Benefit Packages

How to Claim the COVID-19 Health Benefit Packages

PhilHealth has made the process easier for its members. CIUs and hospitals will be the ones to file and submit the claim within 120 days on the date of the patient’s release.

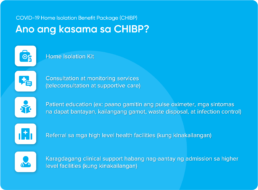

COVID-19 Home Isolation Benefit Package (CHIBP)

According to the PhilHealth Circular No. 2021-0014, confirmed COVID-19 patients that have no symptoms or experiencing mild symptoms and are under home quarantine can get a maximum reimbursement rate of Php5,917.

What does it cover?

What does CHIBP covers?

The benefit package covers all identified services needed by Filipinos to manage and monitor their symptoms at home effectively.

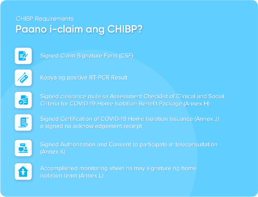

How to Claim CHIBP

How to claim CHIBP?

Just like with CCIBP, PhilHealth accredited CIUs, infirmaries, hospitals, and konsulta providers will be the one to file the claim.

With the growing number of cases in the country, don’t hesitate to seek the proper medical aid that you need. These health care services can help fight against COVID-19 in the Philippines. If you’re feeling any symptoms, contact the nearest CIU or hospital to get yourself checked out.

And if you need financial support, you can learn how to claim government cash aid here.

Let’s stay safe everyone!

Sustaining and Rebuilding Filipino Lives Amidst Corona

Photo courtesy of Hannah Reyes Morales via The New York Times

With the world on lockdown because of the coronavirus outbreak, the normal busy and noisy life of Filipinos has ground to a halt.

Government offices and non-essential businesses are closed, classrooms of all levels are sitting empty, and public transport banned the busy streets of Metro Manila are now eerily quiet and clear of people.

The majority of the population is now under enhanced community quarantine and are strictly advised to remain in the safety of their homes for the coming weeks until the COVID-19 pandemic dies down.

Some workers and companies have the privilege to work from home and continue their business as usual.

“But for the country’s skilled workers, no work means no earnings, and for some, that means no food to put on the table for their families.”

With a population that consists of mostly blue-collar workers, how do we sustain and support these Filipinos in the time of COVID-19?

Gov’t to Provide Social Amelioration to Low-Income Filipino Households

Photo courtesy of Inoue Jaena via Rappler

On March 25, the government passed into law the Bayanihan to Heal as One Act (RA 11469) to implement nationwide social amelioration measures to aid the vulnerable sectors throughout the enhanced community quarantine (ECQ) period.

DSWD Secretary Rolando Bautista said that the Social Amelioration Program will focus on the most vulnerable citizens of society, and prioritize on 18 million poor Filipino households.

The Department of Budget and Management (DBM) has released PHP100 billion to the Department of Social Welfare and Development (DSWD) to cover the funding requirements for cash aid for Filipinos to mitigate the impact of the coronavirus disease 2019 (COVID-19).

The released amount shall be used for the protective services for individuals and families especially in difficult circumstances, or assistance to individuals in crisis situations, and shall be extended to the target low-income household beneficiaries in the form of cash.

The cash aid for Filipinos is between P5,000 to P8,000 and it will be given to vulnerable sectors of society such as persons with disabilities, senior citizens, pregnant mothers, homeless persons, and workers in informal sectors, the DSWD said.

Those who want to avail of the financial or cash aid must fill out and submit the social amelioration card to be included in the local government’s list of beneficiaries, the DSWD said.

Cash Aid for Filipinos Working Overseas

Photo courtesy of Avito Dalan via Philippine Canadian Inquirer

With an estimate of 2.3 million Overseas Filipino Workers (OFWs), the Inter-Agency Task Force for the Management of Emerging Infectious Disease (IATF) has endorsed the proposal of the Department of Labor and Employment (DOLE) to release more than a billion pesos for financial assistance to overseas Filipino workers (OFWs) affected by the COVID-19 pandemic.

In its Resolution No. 15 dated March 24, the IATF endorsed the DOLE’s proposition to immediately release P1.5 billion. DOLE’s proposal aims to give cash assistance to an estimated 350,000 formal and informal workers who were not able to go to work due to the enhanced community quarantine.

Land-based and sea-based workers will be given the cash assistance amounting to $200, or the equivalent amount in their host countries, through DOLE’s Abot Kamay ang Pagtulong (AKAP) program.

For overseas Filipino workers who lost their jobs due to COVID-19 and are still abroad, they are entitled to cash aid and can request for repatriation. They will also be given $200 (P10,000) assistance.

OWWA RWOI’s OIC-Director Gerardo C. Rimorin advised the OFWs to use the Php 10,000 wisely as it is still undermined when the government will lift the ban.

“We hope that through that cash assistance we have given you a sort of relief. Spend the money wisely, use it for emergency purposes if possible”, he said.

DOLE Secretary Bello also said in his press release, “this assistance program is good until the available funds are used up.” Should the enhanced community quarantine be extended, Bello recommends that the national government the extension of the cash assistance program or CAMP to help our modern-day heroes.

Financial Assistance for our Agriculture Workers

Photo courtesy of Philippine Information Agency

Not only are skilled workers and OFWs are affected by this sudden phenomenon. In fact, farmers and agriculture workers are also greatly affected since they cannot deliver their fresh produce to different parts of the country due to community quarantine.

The Department of Agriculture (DA) re-assured the public that over half a million small rice farmers nationwide will receive cash aid of P5,000 while Luzon remains under an enhanced community quarantine amid the coronavirus disease (COVID-19) pandemic.

Agriculture Secretary William Dar said in a statement, “our rice farmers will receive it as a direct cash transfer that they can use to buy either farm inputs, food for their families or anything they need.”

The Growing Importance of Mobile-First Banking and Online Banking

Photo courtesy tirachardz via Freepik

The coronavirus pandemic is rapidly reshaping the way people around the world live their daily lives. Both social distancing and calls to stay at home to avoid unnecessary interactions mean rethinking how you approach daily tasks, including money management.

With limited access and movement to basic activities, Filipinos now find it difficult to conduct financial transactions such as withdrawing money, receiving or sending funds, or to pay for purchases and bills.

The coronavirus outbreak has highlighted the need to enable households, especially the vulnerable sector, to perform basic financial transactions online or through their mobile phones.

Banks have activated their business continuity plans that aim to ensure deposit-taking, ATM withdrawals, check clearing, and other banking activities. While doing so, the Bangko Sentral ng Pilipinas even encourages the use of e-banking and digital payment services as this enables the public to carry out needed financial transactions safely amid this public health crisis.

The Future is in Digital Banking

Photo courtesy elleaon via Freepik

The fight against COVID-19 is far from over. With the threat of a second wave of cases, the smartest and safest choice is to go digital.

Online and mobile banking used to be a matter of personal convenience; now it is a matter of personal safety. That is why investing in digitizing banks, may it be rural or international banks, should be a top priority for these financial institutions.

It might seem distasteful to be considering the future of digital banking at such a time but digital banking is the urgently needed and long-term solution that needs to take place.

Not only is this the case for international and major financial institutions, but for small ones as well. Imagine digitizing rural banks in the Philippines.

“As one of the catalysts for financial inclusion, rural banks have the access and capability to reach far-flung areas and loop-in our fellow countrymen to modern banking.”

Our farmers, fishermen, and other skilled workers would not have to travel far to send money to their families. There would be no need to wait a day or two to receive remittance or aid from families abroad. All financial transactions can be done online with a few clicks at no more additional cost.

Through digital, we can further improve financial inclusion and provide better bank operations and conditions. Filipinos all over the Philippines will not have to worry about going outside to perform any type of financial transaction.

“With the coronavirus pandemic or not, it’s time to leverage the power of digital and give every single one the access to better banking and financial services. Digital banking shouldn’t be done in the future; it should be now.”

COVID-19 Financial Support: Everything you need to know

Millions of Filipinos are struggling because of the COVID-19 pandemic. Because of this, the government is providing Filipinos with the financial support they need. Take a look at the list of cash aid programs available.

Government COVID-19 Financial Support

The president signed Republic Act 11469, also known as the Bayanihan to Heal as One Act, into law last March 25. It addresses the current situation in the country by providing support to Filipinos heavily affected by the pandemic.

What is Social Amelioration Program

Under the Bayanihan to Heal as One Act, the Department of Social Welfare and Development (DSWD) will provide social amelioration measures to Filipinos most affected by the COVID-19 situation. Cash aid between PHP5,000 to PHP8,000 will be given to the most vulnerable sectors.

Who are the qualified beneficiaries for cash aid?

The Inter-Agency Task Force for the Management of Emerging Infectious Diseases released a list of target beneficiaries for government cash assistance.

- Senior citizens

- Person with disability

- Pregnant and lactating women

- Solo parents

- Distressed OFWs

- Members of the poor indigenous community

- Homeless Filipinos

- Informal economy workers (directly hired, subcontracted house helpers, public utility drivers, street vendors)

- Anyone who earns wages below the prescribed minimum rate (dishwashers and helpers in carinderia, etc.)

- Employees with no-work no-pay situation

- Entrepreneurs with an asset of less than P100,000

- Family enterprise owner

- Farmers

- Fisherfolk

- Stranded workers who cannot return to their places of residence at the moment

How to Apply for Social Amelioration Program

DSWD, in coordination with local government units, will give out Social Amelioration Card (SAC) forms on a house-to-house basis, observing proper safety protocols and social distancing when distributing the emergency cash aid to families.

The SAC will be the basis for the government to provide support and will serve as proof that beneficiaries received the cash aid.

- The head of the family will fill up 2 copies of the SAC form. The information must be complete and written in capital letters.

- Submit one copy to the LGU’s authorized personnel while the other copy must be kept by the household.

- Once approved, cash aid from DSWD will be distributed by your local government unit.

- Beneficiaries may be asked to show proof of status, such as senior citizen’s ID for senior citizens, or barangay certification for homeless persons

Supplemental Amelioration Program

Updated information on May 13, 2021

On March 29, 2021, President Rodrigo Duterte approved the Supplemental Amelioration Program. The program will provide financial or in-kind assistance to families or individuals affected by the stricter Enhanced Community Quarantine in the National Capital Region (NCR) and in the provinces of Bulacan, Cavite, Laguna and Rizal.

The Department of Social Welfare and Development (DSWD) announced that the cash assistance is only P1,000 per person and P4,000 for each family with 4 members, regardless of the number of people in the family. The funds will be released by the Department of Budget and Management (DBM) to the local government units for the distribution of in-kind assistance.

Financial Aid for Workers

One of the Philippine cash aid programs is from the Department of Labor and Employment (DOLE). The department will help affected employees and provide one-time cash assistance of PHP5,000 to formal and informal workers who have flexible working arrangements or those working for companies that are temporarily closed.

For Informal Workers

DOLE implemented emergency employment assistance called Tulong Panghanapbuhay sa Ating Disadvantaged/Displaced Workers – #Barangay Ko Bahay Ko (TUPAD BKBK) Program. The program aims to help underemployed, self-employed workers, and displaced workers affected by the pandemic and will be carried out by the barangays or local government.

How to Apply for TUPAD #BKBK Program

Interested workers can inform their barangay or LGUs, such as the city hall, that they want to work under the TUPAD Project.

LGUs must submit the needed documents to the nearest DOLE field offices:

- Letter of Intent

- Work Program

- List of Beneficiaries

Beneficiaries under the program will disinfect their houses and vicinities, in coordination with the local health offices, and will receive a daily minimum wage for 10 days. They will also get personal accident insurance, personal protective equipment, and a cleaning kit.

For Formal Workers

Under the COVID-19 Adjustment Measure Program (CAMP), DOLE will provide support to affected employees working in companies that adopted a flexible working environment or have been temporarily closed.

COVID-19 Adjustment Measure Program Steps

Employers must submit the necessary documents via email:

- Establishment Report on the COVID-19

- Company Payroll for February or earlier (before the implementation of flexible working arrangements or temporary closure)

It must be submitted to the appropriate DOLE-NCR field office with the email subject: APPLICATION FOR COVID-19 AMP. You can check the contact details here. The application will be evaluated and recipients will be notified if it’s approved or denied via email or SMS.

The department also announced last March 31 that employees can apply for CAMP on their own. DOLE will send the money via money remittance service.

Financial Assistance for OFWs

OFWs who have lost their jobs will be given a one-time cash aid of PHP10,000. Affected OFWs must submit their Certificate of Employment from their agencies and will be evaluated by the Philippine Overseas Labor Office (POLO).

How to Apply

How to Claim OFW Financial Assistance? [Updated information on April 13, 2020]

1. Fill up the application form for special cash assistance from POLO

2. Submit the form and the following documents to the nearest POLO office.

- A copy of passport or travel document

- Proof of overseas employment

- Proof of loss of employment due to the coronavirus outbreak

- For the undocumented: Proof that the OFW is involved in a case like case reference number or case endorsement stamped by POLO

3. POLO will evaluate the documents within 5 working days and the applying OFW will be updated within 5 working days.

4. Once approved, OFWs will receive the money through bank transfer or cash remittance.

OFWs who are still abroad are advised to get in touch with POLO in their country to avail the assistance.

We hope that this COVID-19 financial support list helps you during this crisis. Stay safe mga kababayan!

The PearlPay Way: How to Hire Employees and Influence the Right People

Photo courtesy to Ms. Ivy Rosario of Little Things PH

Words by Chief Information Security Officer and Co-founder Nap Catilo.

Hiring is aggravating, tedious, and hard. We startups, against everyone in the market out there, know this too well. But it is gratifying when the result of such efforts make a positive impact on colleagues and to the enterprise. After all, the hiring process helps great employees learn how to find the right company to work for.

I took on hiring key engineers when PearlPay and Unosoft started up. I had recruited software engineers for projects I led in the UK and past ventures here in the Philippines. I embraced the task while my colleagues focused on their immediate objectives at the time.

PearlPay is now scaling up to double its current headcount of around 35 people in its Ecosystem team by summer. We aim to triple that by the end of the year. Unosoft is to scale up with more engineers later too.

We are thankful that driven, considerate, talented people that were looking for a job joined us last year. Our hiring methodology has paid off so far. And we’re to sharpen this up further on upcoming campaigns.

We focused on hiring key people from the start not only with the skills we require but who would also build-up the foundation of our ethos.

Now, all my colleagues are involved in the process with a better idea of what traits in people we should be after and how to go about it.

What makes a Great Employee?

Photo courtesy Peoplecreations via Freepik

Technology in our age is like white sand forever shifting under our feet. We stand still at our peril.

Great employees know this well. They know a lot already but may not yet be on things we’d need them for. So they are teachable. They are great at learning what needs knowing when needed. Some even become experts on the next big thing by their own volition. We startups pay close attention to candidates with such dexterity. We give them every opportunity to grow and be influential to the team once on-board.

They possess and express their passion to learn and work, their aptitude to do all these things and the humility to be taught by anyone and collaborate with everyone effectively.

They work well in isolation yet thrive in a team environment too. They know how to work in a team well and what makes great teams work. They communicate their ideas and teach others well. Perfection is their North Star yet they make decisions with practical clarity.

They have skills in both technology and people. Not all possess both in equal measure. So the equilibrium is key by complimenting different areas and levels of their capabilities to each other. This balancing act occurs naturally due to some in the team who possess stronger people skills.

This is why great employees are strict in finding the right company to work for. The chances of good employees turning up on one’s shortlist for interviews are slim at times. But if a promising candidate is foreseen by one to become a great addition to the company one day, to be in a team with the right culture, they will be.

Culture Matters to them Too

Photo courtesy jcomp via Freepik

The right culture in a team would be the spirit that cultivates tenacity, agility, diversity, compassion, and camaraderie. These are what make up an organization as one of the best companies to work for. It inspires excellence and respect in one’s self and of each other. It has a major influence on the success of an enterprise.

As a Fintech company in the Philippines, our mission is to make financial services universally accessible. Its reach is vast. Its scope is ambitious. Its rate to scale is to be exponential.

Micromanagement won’t cut it. Instead, the right culture would shape the team that everyone would think for themselves yet take care of each other, would do the right thing, won’t sit on the bench for long and won’t quit.

Of course, one should hire people that match the criteria required by the enterprise to deliver its objectives, another factor that jobseekers look into when finding the right employer.

It pays to holistically look for attributes in candidates that will contribute, nurture the culture and performance of the team – qualities beyond the job description and technical criteria.

Otherwise, such oversight may short-change the enterprise later – even hurt its prospect in the long run.

Also, they are to be ambassadors of the team and its enterprise to everyone out there. With such traits, they serve this role naturally.

And they will volunteer to get involved in the hiring process later too – to screen, interview and evaluate.

Birds of a feather flock together, as the saying goes. And hiring people is no different.

Selecting the Right Candidate for the Job

Photo courtesy mentatdgt via Pexels

I’ve found that pair-coding with candidates is the most effective test when hiring for our engineering team.

Technical questionnaires and brain teasers were a waste of time for me in the past. These would tell me what they already know about stuff anyone can look up on the internet. These don’t predict or reveal anything else about the candidate.

Some applicants would not reply back to my email invite for a pair-coding session. The invitation does its job of saving my time from being wasted. The applicants we should care about are the ones up for the challenge, especially those who fear it but do it anyway.

I ask them to bring their own laptops if they have one. A dedicated coder usually would have their own machine rigged with their own software, IDEs, etc configured to their preference.

The pair coding session proceeds after the verbal interview. I give them instructions on what to code. Either I start the build for the candidate to complete it or they start by themselves from scratch. Then I leave them to complete their build; check on them after about 20 minutes.

If they complete it without problems, I ask them to extend their build with more complex tasks like how they would write tests with it or how they would design a business rule enforcement with tests bolted to it, for instance. The level of complexity of what they’re to complete next depends on the level of confidence and knowledge they have displayed so far.

If they haven’t completed their work, I would sit beside them and complete it in front of them. If the technology stack we’re after isn’t my forte, I either delegate the session to someone in the team who knows it or ask the candidate to build one from scratch by themselves and guide me through the stack and their coding work.

I then give a critique as I go through their work; write code with them if need be. Our interaction at this point is the highlight of my evaluation of them.

Half the skill of a great candidate is how well they comprehend what they need to know, what they have to do to deliver their work e.g. skills, knowledge, etc.

The other half is how well they diagnose problems; how their aptitude aids them to solve such issues – like a detective solving a crime.

They don’t necessarily have to complete the work to pass.

But how much did they care about how they did at the session? Did they care when they didn’t complete their task? How well did they use resources like the internet to solve their issues? Their interaction with me at these sessions tells me enough about their level of capability, their capacity to learn (or how well they tolerate it), their communication skills, intuition, etc.

Great Interns make the Difference Too

Photo courtesy Pressfoto via Freepik

Knowing how to find the right company to work for isn’t just applicable to jobseekers but to interns too. We evaluate internship candidates with exacting criteria on aptitude, passion, and humility just like with job applicants. And they get valuable experience should they come through for their internship with us.

We had an intern who flew in from Switzerland. He learned about PearlPay; how our program for financial inclusion is developed for the rural community.

A documented business case written by another intern attracted attention from potential investors in Japan – one among other assets produced by them at PearlPay.

They too become the team’s ambassadors at their campuses and to their peers.

Making valuable time and due care for young minds – our future leaders, future entrepreneurs – makes the difference to any enterprise. It certainly has for us.

Evangelize the Mission

Photo courtesy jcomp via Freepik

And the biggest factor in learning how to find the right company to work for is the company mission. It helps them decide whether or not they want to work with a company or not.

We startups have our mission to accomplish. We evangelize about it to investors and potential partners with great aplomb.

I pitch the mission to candidates as if I’m talking to an investor; attempting to raise capital for the team. I use a visual aid on my iPad – either a pitch deck about PearlPay from the team or a journal in PDF written by our Co-Founder and CEO, Spark Perreras.

I attempt to impress them with our mission; make them understand this is an opportunity of a lifetime for them to be part of. The mission is valuable to us so we don’t just hire anyone – a piece of gem that we don’t just give away. So they have to impress me too.

One candidate was rather taken at her interview that she recommended her colleagues to apply too. “I fell in love with PearlPay”, she said to her ex-colleague who later applied and became a key member of ours. He is now a Senior Engineer at our Ecosystem team.

Another great candidate, a Project Manager, jumped ship to ours – a startup with a humble working capital and workplace in Makati – from a competitor who had been in business a lot longer than us with a plush office floor at an exclusive location in Taguig.

Great people want their work to mean something; what value they will be contributing to.

To cite Mr. Nestor Tan, CEO of BDO Unibank Inc, from whom Spark learned this nugget of wisdom from his time at the bank and shared to us:

Excite them. Keep them interested. Tell them it’s doable.

Helping Farmers in the Philippines with Accessible Financial Help [INFORGRAPHICS]

Learn more about how accessible financial help can further support farmers and improve agriculture in the Philippines here!

Helping Farmers in the Philippines with Accessible Financial Help

The Philippines is a well-known agricultural country— blessed with fertile 30 million hectares of land for farming and surrounding fresh sea waters that encourage healthy and sustainable fishing.

President Duterte even declared it himself that “Philippine Agriculture is the backbone of the Economy. It forms the basis for food and nutrition security and provides raw materials for industrialization.“

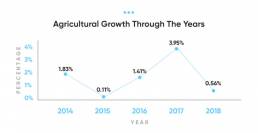

But in recent years, the Philippine agricultural growth has been erratic and has been in steady decline for a decade. The growth of the sector in 2014 was 1.83 percent, slid to 0.11 percent in 2015, and inched up by 1.41 percent in 2016. In 2017, it grew by 3.95 percent but posted a dismal 0.56 percent growth in 2018.

The reasons for the decline are all too familiar Philippine agriculture issues: low productivity, limited product diversification, high production costs, and low government support relative to other sectors of the economy. Then comes the entrance of cheaper food imports and climate change that has brought periodic droughts and floods that devastated crops and livelihoods.

“But why is the country’s lifeblood, the poorest and the most underserved industry the whole economy?”

Let’s dig deep into one of the primary hurdles of farmers in the Philippines: financial support.

Filipino Farmers Underserved and Under Siege

Photo courtesy of Tuan Anh Tran via Unsplash

On February 14, 2019, President Rodrigo Duterte signed Republic Act 11203 or the Rice Liberalization Law to minimize inflation rates after he imposed the Tax Reform Acceleration and Inclusion (TRAIN) Law back in 2018. The Rice Liberalization law claimed to be beneficial to Filipino farmers. Data from Philippine Rice Research Institute (PhilRice) says otherwise, showing a P61.77 billion loss to Filipino farmers due to the rice import liberalization law.

In another study by the Bantay Bigas watch group, Filipino rice farmers lost at least P74.8 billion in 2019 due to low farmgate prices of palay, citing the Rice Liberalization Law as the primary culprit to blame.

Other than the financial difficulty that Filipino farmers face, they are also under siege with the administration.

In a study by international advocacy group Pesticide Action Network-Asia Pacific (PAN-AP), the Philippines ranked as the top country dangerous to land rights advocates, especially Filipino farmers, with the death of 76 farmers out of 98 political killings in Southern Mindanao.

Dawn af a New Agricultural Decade

Photo courtesy of Rexy Quieta via Unsplash

The government may have succeeded in distributing lands to farmers through Agrarian Reform, but it failed to help farmers sustain the area they were given.

Enter Quirino Representative Junie Cua with House Bill No. 5681 (HB 5861) or the “Rural Agricultural and Fisheries Financing Enhancement System Act.” The bill underscores the need to organize and train Filipino farmers in cooperatives with professional managers who can access credit financing from banks.

According to Cua, “One of the serious problems besetting our farmers and our fisherfolk is the lack of financing, lack of credit. Why? Because it is costly to lend to small farmers. The cost of lending is very high.”

That is why HB 5861 seeks to promote rural development by enhancing access to rural communities, agricultural, and fisheries households to financial services and programs.

The bill also seeks to set up an agricultural, fisheries, and rural financing system to improve the welfare, competitiveness, income, and productivity of rural community beneficiaries, particularly farmers, fisherfolk, and agrarian reform beneficiaries.

What HB 5681 means to Farmers in the Philippines?

Photo courtesy of MENAFN Website

With HB 5681 coming into the place, the bill mandates all banking institutions, whether government or private, to set aside a credit quota or a minimum mandatory agricultural and fisheries financing requirement of at least 25 percent of their loanable funds.

Under the bill, agricultural, fisheries, and rural financing shall consist of loans, investments, and grants to finance activities that shall enhance productivity and competitiveness, as well as sustainable development of rural communities.

Initial contributions include penalties due from banks on their compliance or under-compliance with the mandatory Agri-Agra credit requirements under Republic Act No. 10000, collected after the effectivity of the proposed Act, the net of the ten percent amount to be retained by the Bangko Sentral ng Pilipinas (BSP). It is expected the amount shall not be less than P10 billion; any shortfall will be filled in and contributed by the banks themselves.

Any violators of the Act will result in penalties on non-compliance or under-compliance and shall be computed at one-half of one percent (0.50 percent), or any rates prescribed by the BSP Monetary Bard.

The HB 183 also mandated the Land Bank of the Philippines (LANDBANK) to “focus on its Charter to allocate sixty percent (60%) of its total loan portfolio in solely providing support and financing services for farmers and fisherfolk.”

“The bill seeks to promote inclusive growth and improve the quality of life in the countryside. It will foster continuity and expansion of responsive financial and support services to all farmers and fisherfolk,” Deputy Speaker Michael L. Romero said in a press release.

An Additional Aide for Filipino Farmers

Photo courtesy of Mau Victa via Rappler

To further aid farmers in the Philippines, the Social Security System (SSS) and Philippine Crop Insurance Corp. (PCIC) is set to bring social security coverage to one of the most vulnerable sectors of society, our farmers and fisherfolk in the provinces.

With the help of PCIC’s regional network, SSS can now over more potential members, a pension fund that provides social security protection in times of sickness, maternity, disability, unemployment, retirement, funeral, and death.

The collaboration between SSS and PCIC brings immense security to farmers in the Philippines since PCIC can provide insurance protection to farmers and fisherfolk in times of calamities, plant diseases, and pest infestation. While SSS can help and encourage agriculture workers to develop financial independence.

With a partnership like this, Filipino farmers will no longer cling to informal lenders, and loan sharks with rates go as high as 20 percent a month. They can rely on their own, with the help of these organizations, to help cultivate their land and build their future.

The Future of Farmers in the Philippines

Photo courtesy of MENAFN Website

As the Filipino adage goes, “magtanim ay ‘di biro” (farming is not a joke). It’s not only physically difficult but nowadays financially as well. That is why we need to support Filipino farmworkers in any way we can.

With all the partnerships and bills set in place for Philippine agriculture,there is a hopeful spirit in the air that the future could look bright for our Filipino farmers in the coming decade.

Digital Banking as the Solution

Photo courtesy of WorldBank Website

With loopholes in the providing finances to the agriculture sector, public and even private companies and institutions are chipping in to help support and save the country’s lifeblood.

Other than the government aid provided, digital banking is paving the way for people in rural areas, especially our agriculture workers, for better financial support.

By digitizing rural banks—that have an expansive reach to the rural and agriculture community— we can bring more Filipinos into the formal financial system. This will enable us to deliver a whole range of financial services catering to the unique needs of farmers and their communities.

![A New Decade Of Digitalization | Part 1 [INFOGRAPHICS]](https://sandbox.pearlpay.com/wp-content/uploads/2020/05/A-New-Decade-of-Digitalization-Infographics-Banner-uai-258x139.jpg)

![How to Claim OFW Financial Assistance? [Updated information on April 13, 2020]](https://sandbox.pearlpay.com/wp-content/uploads/2020/04/OFW-Financial-Assitance-Updated-uai-258x90.jpg)